- #Setting invoice number in quickbooks 2016 for mac how to

- #Setting invoice number in quickbooks 2016 for mac pro

- #Setting invoice number in quickbooks 2016 for mac plus

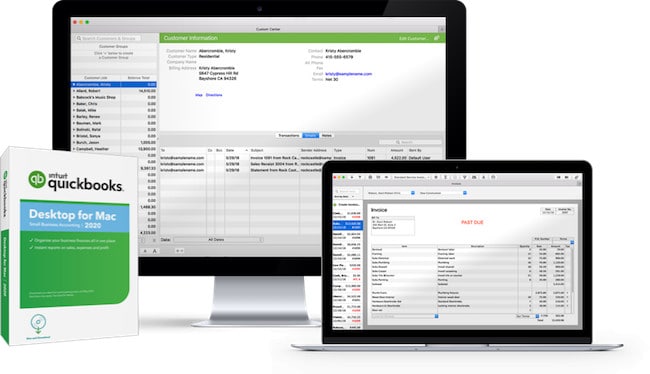

Supports one Workstation Monitor, plus up to 2 extended monitors. Optimized for 1280 x 1024 screen resolution or higher.Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions and fees. Download your data from participating banks until May 2022.E-mail Estimates, Invoices and other forms with Microsoft Outlook 2010-2016, Microsoft Outlook with Office 365, Gmail™, and ®, other SMTP-supporting e-mail clients.Microsoft Word and Excel integration requires Office 2010 SP2 – 2016, or Office 365 (32 and 64 bit).Transfer customer credits across jobs, quickly and easily.Reliably and significantly reduce file size without deleting data.Significantly boost your productivity with multi-monitor support 3.View unpaid bills from a vendor to easily manage payments.Improve your cash flow by tracking invoice status at a glance.Create professional estimates and invoices.Access to the latest features and updates.

#Setting invoice number in quickbooks 2016 for mac pro

Why Pro Plus? Pro Plus includes QuickBooks Pro features with more! And in 2020 you can expedite collections and improve cash flow by tracking up to date invoice status.

#Setting invoice number in quickbooks 2016 for mac how to

1 Have questions? Step-by-step tutorials show you how to create invoices, record expenses, and more. Stay on top of invoices, manage expenses, get reliable reports for tax time and import your data from a spreadsheet. If you need to review any invoices that have been voided or deleted, you can do so by clicking the Reports menu on the menu bar, then click Accountant and Taxes > Voided/Deleted Transactions Summary (or you can view detailed).QuickBooks Desktop Pro Plus helps you organize your business finances all in one place so you can be more productive. Click Save and Close at the bottom of the invoice to save your changes.ĥ. If you void the invoice, the monetary amounts will be zeroed out. If you Delete an invoice, QuickBooks will ask you to confirm that you want to delete this transaction. After you have located the invoice, click the Edit menu on the menu bar, then click Void Invoice or Delete invoice.Ĥ. Locate the invoice number that you want to void/delete.ģ. To select an invoice to void or delete, click the Create Invoice icon on the QuickBooks homepage.Ģ. Here is a summary of the steps that were performed in the video:ġ.

To void or delete an invoice, follow the steps that were performed in the video below: If you need to review any invoices that have been voided or deleted, you can do so by clicking the Reports menu on the menu bar, then click Accountant and Taxes > Voided/Deleted Transactions Summary (or you can view detailed). Choose this option if you have not issued the invoice to your customer. If you delete the invoice, then there will not be any trace of it at all. Voiding the invoice allows you to keep track of it for any future business reasons. This option may be useful if you have issued an incorrect invoice to a customer. However, the invoice number and the items that were added on this invoice will remain there will be no monetary amounts on a voided invoice.

If you void an invoice, it will no longer exist in your accounting balances as well as your customer balance. Lesson 6-5:There will be times when you may need to void or delete an invoice.

0 kommentar(er)

0 kommentar(er)